Main content starts here.

About Forestry Insurance

Forestry Insurance is only insurance that allows forest owners to comprehensively prepare for forest fire, meteorological disasters (wind damage, flood damage, snow damage, drought damage, frost damage, tidal damage), and volcanic eruption disasters in Japan.

This insurance system was established to prevent disasters from hindering the reproduction of forestry and to ensure the stability of forestry operations.

Summary of Foresty Insurance

|

Establishment |

1937 |

|

Legal Basis

|

Forestry Insurance Act Forest Research and Management Organization Act |

|

Insurer |

Forest Research and Management Organization |

|

Insured Persons |

Forest Owners(Forest owners whose forests are the subject of forestry insurance) |

|

Covered Damages

|

Fire, meteorological disasters (wind damage, flood damage, snow damage, drought damage, frost damage, tidal damage), volcanic eruption disasters no other private insurance in Japan covering meteorological and volcanic eruption disasters for forests |

|

Financial Method

|

The Forestry Insurance Account has been established. Forestry Insurance is operated solely with premium income as its funding source. no financial assistance from the national government |

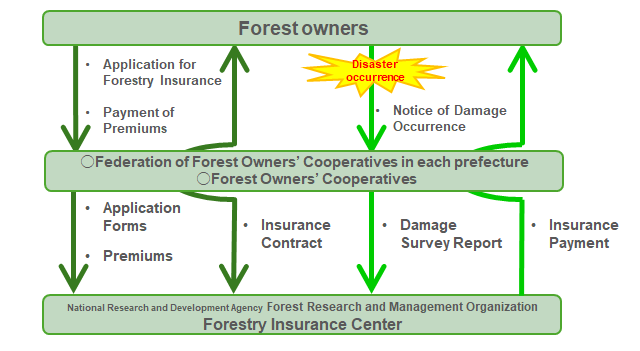

Insurance Contract and Insurance Payment

Four Missions of the Foresty Insurance Center

1 Improving Services for Insured Persons

|

UAV-based On-Site Damage Surveys for Faster Insurance Payments |

2 Promotion and Enrollment in Foresty Insurance System

|

Forestry Insurance Newsletter (Shinrin Hoken Dayori) A publication designed to clearly communicate information about forestry insurance to forest owners and related organizations. |

3 Appropriate Review and Consideration on Conditions for Insurance Underwriting

4 Enhancement of Internal Governance

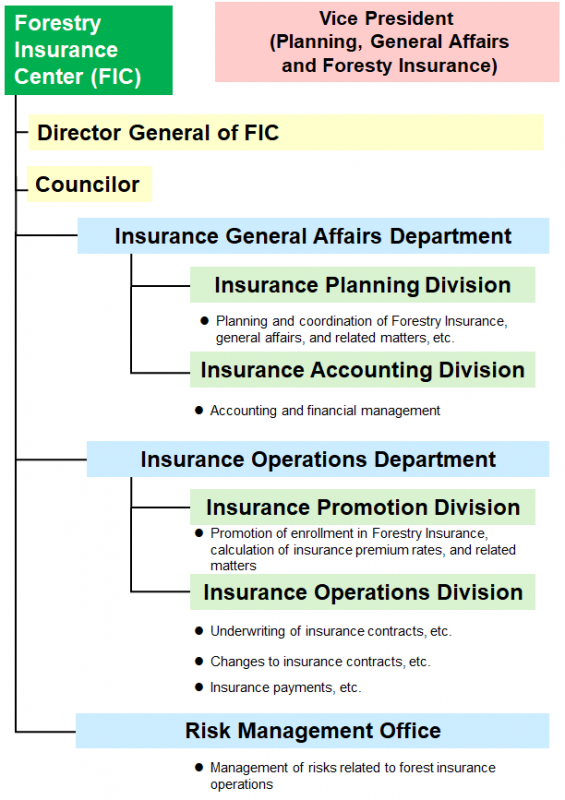

Organization

Copyright © Forest Research and Management Organization. All rights reserved.